The price of Mantle (MNT) has risen more than 6% in the past 24 hours. This wasn’t a surge without a clear driver, but part of a trend that had been building for a week, rising 24% and even 70% in a month.

According to CoinMarketCap data, the biggest catalyst was Coinbase International Exchange, which announced it would begin trading MNT perpetual futures contracts starting August 21, 2025.

The effect was immediately felt in the derivatives market. Open interest surged 22.7% to $122 million, hitting a record high. Derivatives volume also surged to $131 million. It’s hot enough to attract the attention of anyone eyeing the altcoin market.

Investor interest in Mantle grows amid strong Bybit support

Meanwhile, the spot market also moved in the same direction. The altcoin daily volume reached $756 million—up more than 32%. Interestingly, nearly 37% of those transactions took place on Bybit.

Not only that, the net outflow from exchanges actually shows that many traders are withdrawing their tokens to personal wallets. This can be interpreted as a sign of accumulation.

Not only that, Mantle also received additional support from Bybit. They have integrated MNT into their Earn, OTC, and Launchpool products for EU users. The yield offered reaches 36% APR.

Furthermore, Bybit’s August campaign with a total prize pool of 250,000 USDT has also boosted attention. Furthermore, two new names, Helen Liu and Emily Bao, have joined as strategic advisors to the project. It’s safe to say their team knows how to maintain hype.

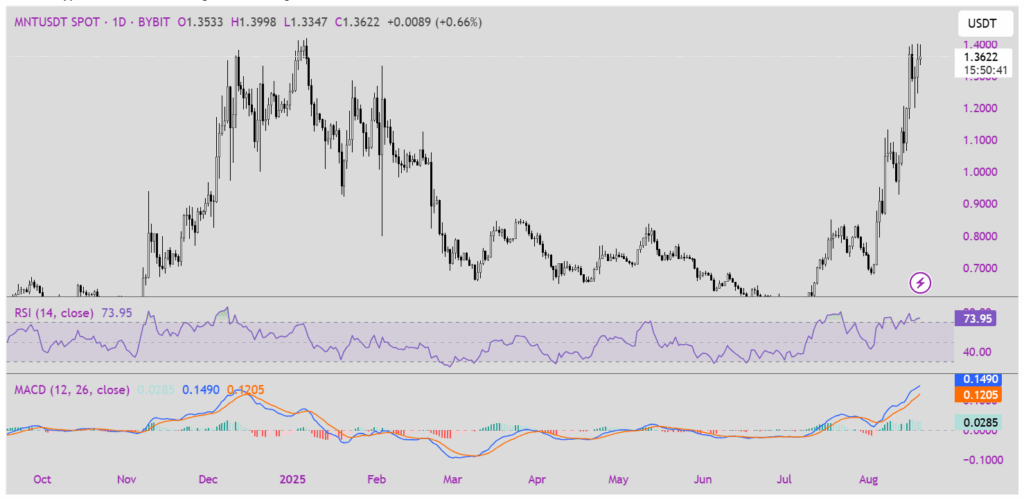

However, from a technical analysis perspective, MNT is approaching a vulnerable zone. The $1.46 level is a strong resistance, not far from its all-time high of $1.51.

Also, the RSI indicator has touched 73.95, indicating overbought conditions.

Profit-taking could occur in the near future, with a potential decline to the support area around $1.25.

Despite this, the MACD histogram remains positive, indicating that upward momentum hasn’t run out of steam. If volume remains high, a rebound remains possible.

In addition, the rising wedge pattern that is starting to form could also be a warning signal for short-term traders.