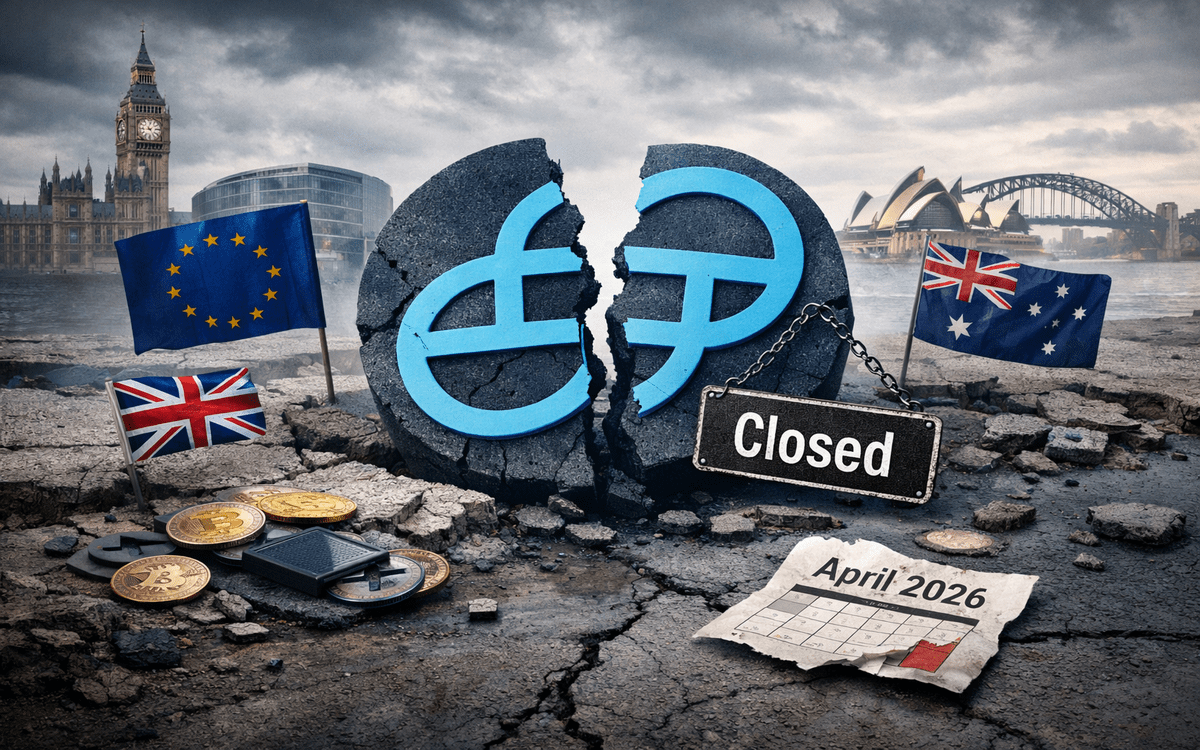

Gemini has confirmed plans to wind down operations across several international markets. The decision affects customers in the United Kingdom, the European Union, and Australia.

The exchange said the move reflects a broader shift in business priorities. As a result, affected users face firm deadlines to secure their funds.

The New York-based crypto exchange, founded by Cameron and Tyler Winklevoss, said customers in the impacted regions will soon lose full platform access.

Gemini stated that accounts will transition into a limited state before permanent closure. The company urged users to act early to avoid complications. It warned that delayed action could restrict withdrawals.

Gemini sets March deadline for trading suspension

According to press release, the customer accounts in the UK, EU, and Australia will enter withdrawal-only mode on March 5, 2026.

At that point, users will lose access to trading, buying, and other platform features. The only withdrawals will remain available during this period.

Gemini said it has stopped new account registrations in the affected regions. It also confirmed that all incentive and rewards programs will end.

The company advised customers to cancel recurring crypto purchases. It also urged users not to send new deposits to Gemini wallets.

Gemini further said customers should begin unstaking any staked assets immediately. It warned that open perpetual futures positions must close manually.

Otherwise, forced liquidation may occur at prevailing market prices. The exchange said failure to act before the March deadline could result in asset loss or delayed withdrawals.

The company set April 6, 2026, as the final date for account closures. After that date, account access will terminate. Gemini said recovery options may remain limited once closures begin.

Strategic shift toward the US market

Gemini has not given a detailed reason for exiting the UK, EU, and Australian markets.

However, the company recently secured regulatory approval in the United States. That approval allows Gemini to enter the prediction markets sector.

According to the company’s statements, this approval signals a renewed focus on domestic expansion.

Gemini appears to be reallocating resources toward new US-based opportunities. The exchange has faced regulatory pressure in several overseas jurisdictions.

Market conditions may also play a role, such as weakening crypto demand in the UK and Europe.

Prolonged volatility and falling Bitcoin prices have reduced retail participation. Gemini did not directly confirm this factor.

The move aligns with a wider trend among US crypto platforms. Several exchanges have scaled back global operations amid tighter regulations abroad. Gemini said it will continue serving US customers without disruption.