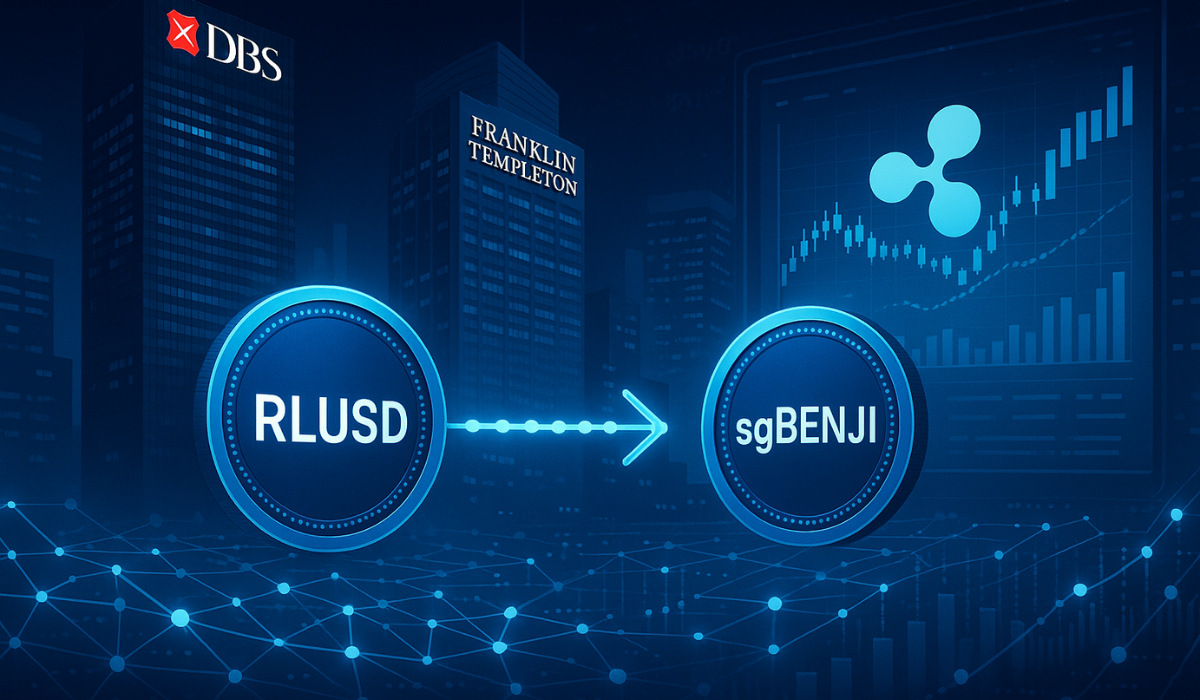

Ripple has joined forces with DBS Bank and Franklin Templeton to push institutional finance deeper into blockchain.

The three firms signed a memorandum of understanding to build repo markets that run on tokenized collateral and stablecoins.

Investors will be able to trade Ripple USD (RLUSD) for Franklin Templeton’s tokenized money market fund, sgBENJI, listed on DBS Digital Exchange.

The move allows institutions to earn yield while navigating volatile markets and brings new liquidity venues on-chain.

The collaboration blends the reach of one of Asia’s largest banks, the expertise of a global investment manager, and Ripple’s blockchain technology.

It represents another step in the rise of tokenization, which has already caught the attention of institutional investors.

A recent survey showed nearly 87% of large investors expect to allocate into digital assets in 2025.

DBS Digital Exchange Lists sgBENJI Alongside RLUSD

Traditionally, investors looking at digital assets leaned toward Bitcoin, Ether, or XRP. These assets bring high volatility but no yield. The new setup addresses that gap.

DBS Digital Exchange will now list sgBENJI alongside RLUSD, allowing accredited clients to trade between a stablecoin and a tokenized fund at any time of day.

Unlike traditional fund trades, which take days to settle, blockchain transactions finalize in minutes.

DBS plans to move further by letting clients use sgBENJI tokens as collateral. That opens repo transactions and credit options while keeping the collateral held by a trusted bank.

The structure gives investors flexibility, safety, and access to liquidity when markets move fast. This phase could transform how institutions handle capital efficiency.

By pairing a stablecoin with a yield-generating tokenized fund, portfolios can shift seamlessly from stability to yield without leaving the ecosystem.

Franklin Templeton to tokenize sgBENJI on XRP ledger

Franklin Templeton will tokenize sgBENJI on the XRP Ledger. Known for speed and low transaction costs, the ledger supports high-volume assets that demand efficiency.

Adding XRP Ledger to Franklin Templeton’s network expands cross-chain access and interoperability. That helps broaden adoption and lowers barriers for participants across the digital asset landscape.

Nevertheless, the partnership signals how traditional finance and blockchain continue to merge.

Institutions demand trusted platforms and efficient products, and this initiative delivers both. It shows how tokenized securities can meet the demands of a 24/7 global market.