BitMine Immersion Technologies is facing nearly $8 billion in paper losses after Ethereum fell below the $2,000 level.

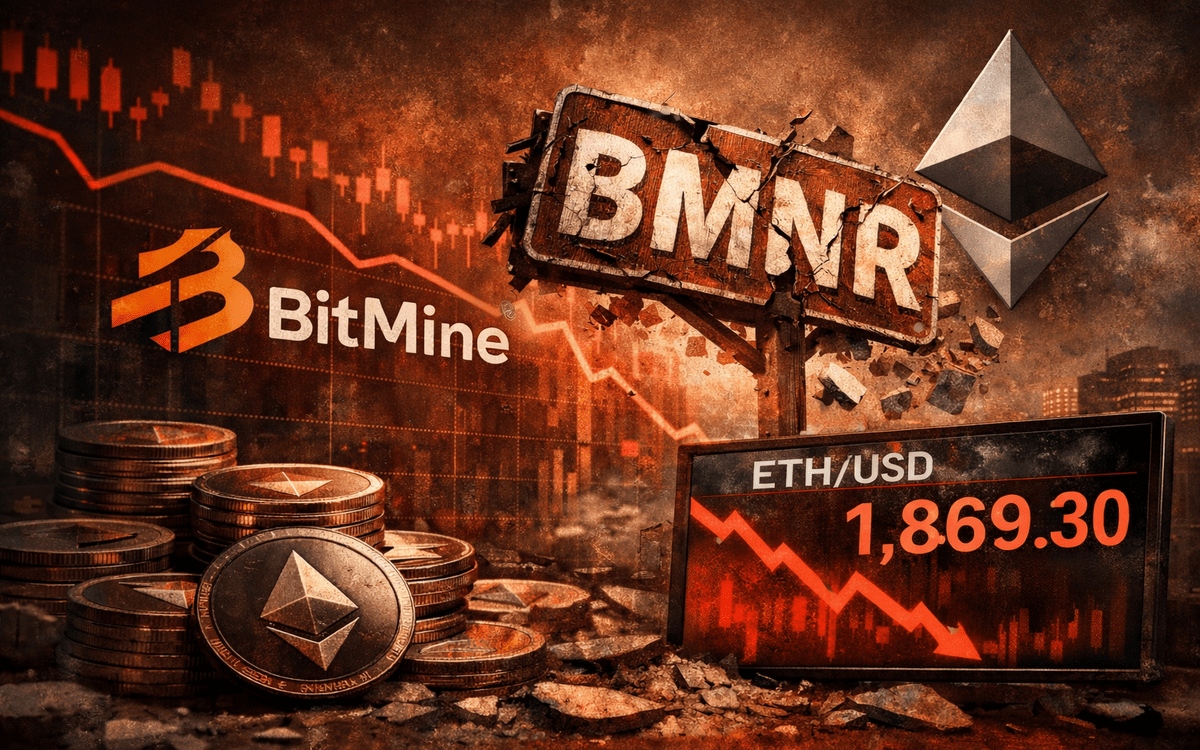

At the time of writing, Ether was trading at $1,869.3, down 11.5%, a move that has sharply reduced the value of the company’s ETH treasury and weighed heavily on its stock.

BMNR shares have tracked Ether’s weakness closely in recent months. Management says its debt-free structure allows it to withstand the downturn.

BitMine Ethereum holdings drive losses and stock decline

BitMine currently holds 4.29 million ETH, acquired at an estimated total cost of $16.4 billion, according to company statements.

At current prices below $2,000, the Ethereum holdings are valued at roughly $8.4 billion. The difference reflects close to $8 billion in unrealized losses driven by Ether’s decline.

The stock reaction has been severe. Since July, BMNR shares have dropped 88% and hit a new low after falling 7% on Thursday.

The sell-off to investor concern over BitMine’s heavy Ethereum exposure during a sustained market downturn. Ether price movements remain a key factor influencing the stock’s performance.

Despite the drawdown, BitMine has continued accumulating Ethereum. The company added 41,788 ETH over the past week.

These purchases extend a pattern of steady weekly accumulation that began in December 2025. Management has maintained that the strategy reflects a long-term view on Ethereum.

Debt-free strategy, staking income, and liquidity

BitMine’s funding model sets it apart from other crypto treasury firms.

Executive Chairman Thomas Lee said the company relied on equity issuance rather than borrowing to acquire Ethereum and other digital assets.

As a result, BitMine carries no debt covenants or repayment obligations. This structure allows the firm to hold its ETH during periods of price volatility.

The company reported a cash balance of $538 million. More than 2.9 million ETH remains staked, generating an annual yield of about 2.81%.

views staking income as a steady revenue source during market weakness.

Beyond Ethereum, BitMine holds 193 Bitcoin and equity investments in other companies. These include a $200 million stake in Beast Industries and $19 million in Eightco Holdings.

Ethereum network activity remains strong, with daily transactions reaching a record 2.5 million and active addresses surpassing one million.

BitMine also ranks among the most actively traded US-listed stocks, averaging $1.1 billion in daily volume.