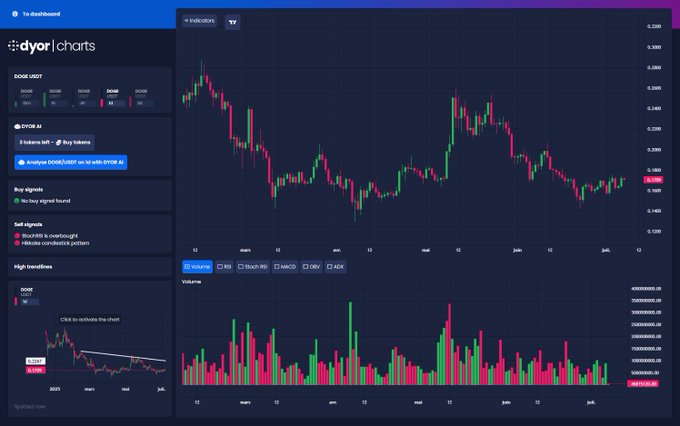

The Dogecoin (DOGE) wave has lost steam since it hit a record of about 0.3515 earlier this month. The memecoin is currently trading under $0.17196, and indicators show it may shift to a bearish fall soon.

The recent analysis provided by DyorNetCrypto shows that the trending score is negative and equals 44, implying a possible decline.

The daily chart shows technical indicators that show increasing weakness in the trend. The Stochastic RSI is also in its overbought position, which in most instances may signal a reversal is soon in-coming.

Despite the recent crypto market surge led by Bitcoin (BTC), which is predicted to hit $140k soon, Dogecoin has failed to maintain its momentum, which has left players in the market worried. The present trends seem to lean towards a negative move in the event that resistance levels are maintained.

Dogecoin faces strong resistance at $0.2271

The resistance level of $0.2271 has formed a power resistance zone and this is currently corroborating with the SuperTrend which is currently giving a sell signal as well. Failure to penetrate this observation may trigger increased selling pressure by Dogecoin.

Conversely, the closest resistance is at the $0.150 range and further falls below that point are likely to bring forth top-like declines at $0.140.

Even though the trading volume in this window is high, the wider trend is not strong. The ADX is 23.78 below the threshold to indicate that the trend is strong.

In the meantime, the Relative Strength Index (RSI) lies at 50.52 and does not indicate bullish power or bearish power. These indicators underline the indecision in the market at the moment.

Despite the upside potential that it still continues to have in the short term, analysts anticipate that there will be minimal gains.

A temporary pullback to the $0.192 to 0.227 mark can be seen in case the demand comes back. It is, however, necessary to keep any situation of bullish nature at a level of caution, and a stop-loss at $0.160 is advisable in order to contain risks. The market mood is shaky and is very sensitive to exogenous influences.

Traders are keeping a close eye on the range that Dogecoin is currently consolidating ($0.150 to 0.227), and it could be a problem soon. Either of the sides breaking out has the potential to determine the next major price action. At least, sideways trading with the increased volatility will be likely to persist until then.

In the meantime, Dogecoin is under downside pressure, as it was unable to overcome the 200-period moving average within the 4-hour chart. On July 7, 2025, the price was $0.17149, a little bit lower than the key resistance of 0.17203. This rejection was followed by a short rally which had since lost its steam.

The moving averages (MAs) that are offering support within the proximity area include the 50 and 100-period, at $0.16609 and $0.16328, respectively.

The Relative Strength Index (RSI) comes in at 58.81, which has come out of the overbought zone. Though it remains above the neutral levels the RSI is on a negative slope indicating condemnation of buying power. This can be due either to traders cashing in or clearing out when faced with some uncertainty.

As volume cooling and volatility is stabilizing, the market appears to be picking up towards a consolidation stage.

To continue the bullish trend, Dogecoin will have to close strong above the resistance at $0.1775, which CoinLore states could be possible within the next 10 days.

An escape into the new territory is likely to be accompanied by a jump to the area of $0.18, whereas the inability to maintain the existing levels can result in a fall below $0.166. That would bring $0.160 in play with risks of further drops.

Traders should be cautious and responsive between these price zones until the time when a pronounced breakout or breakdown appears.